Rethinking CRO Turnover: A Strategic Approach for Mid-Market Private Equity Firms

Chief Revenue Officer (CRO) turnover is an increasingly common challenge for companies striving to accelerate growth, especially in mid-market businesses where revenue strategies can make or break investment success. The high costs of CRO turnover—both financial and operational—are well-documented, but for private equity-backed companies, the implications extend further: CRO turnover can mean delayed returns, missed revenue targets, and an uphill battle in realizing value creation plans.

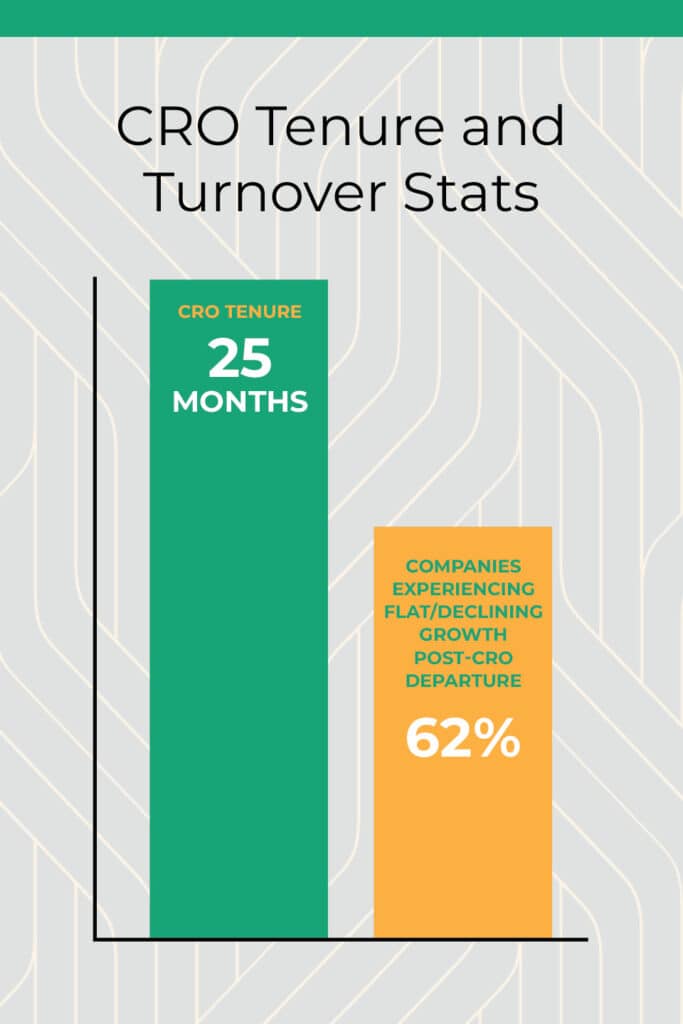

I was intrigued by a recent article from the Harvard Business Review, “The High Costs of Chief Revenue Officer Turnover,” which highlights some key issues. The authors found that CRO tenure is now averaging just 25 months, with a notable 62% of companies experiencing flat or declining growth a year after a CRO departure. While the article’s authors recommend grooming internal candidates to foster continuity, private equity firms may need a broader, proactive strategy.

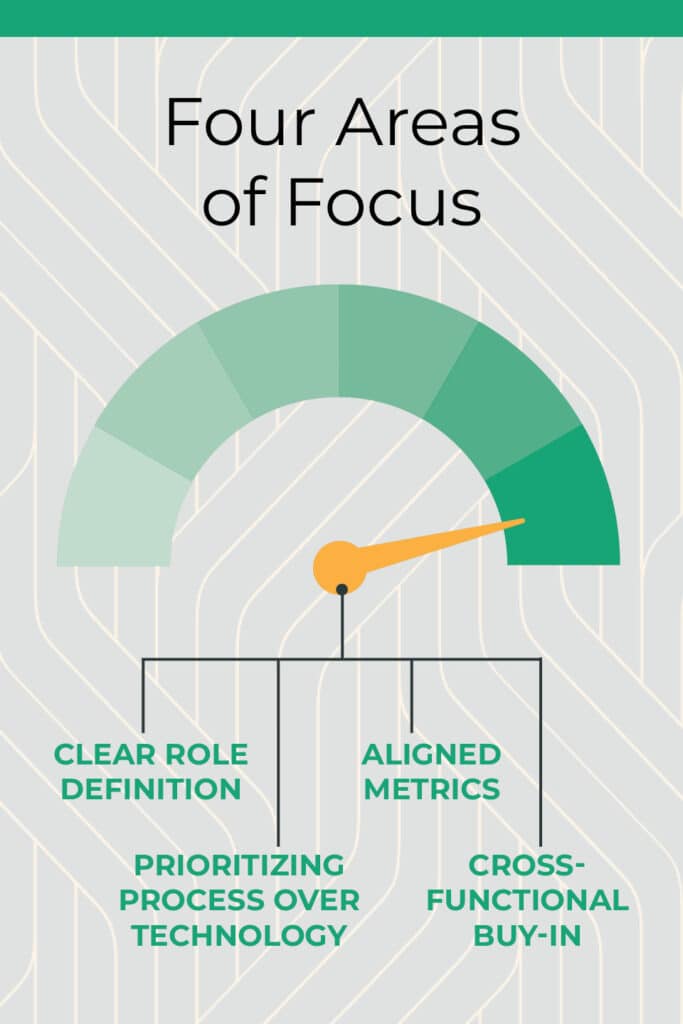

I would like to offer four actionable insights for mid-market PE executives to consider in minimizing CRO turnover and maximizing growth.

1. Clarify the Role: Align Expectations from Day One

The CRO title may be a relatively recent addition to the C-suite, but it’s evolving rapidly. For some organizations, the CRO is a glorified VP of Sales, expected to drive aggressive customer acquisition. For others, the role requires complete alignment of sales, marketing, and customer success. Unfortunately, without clear alignment between the CRO and the CEO or board, the role’s strategic impact is compromised.

Recommendation

Define clear, measurable objectives that match the CRO’s experience with the company’s current stage of growth. Early alignment on specific, actionable goals—whether they’re revenue growth, improved customer retention, or cross-functional integration—sets the stage for success. Ensuring that the CRO’s role matches the growth strategy also reduces the likelihood of misaligned expectations down the line.

2. Measure Success with Aligned Metrics—And Reassess Regularly

Mid-market companies often face the challenge of disparate systems and reporting processes that obscure true revenue drivers. Without cohesive metrics, the CRO’s accountability can become murky, leading to unclear success parameters. This lack of clarity can accelerate frustration, undermine the CRO’s credibility, and lead to premature exits.

Recommendation

Establish metrics that align with both the company’s financial targets and the specific outcomes expected from the CRO. This includes core revenue metrics like MRR (monthly recurring revenue), customer acquisition costs, and customer lifetime value. Schedule regular check-ins to refine these metrics based on performance and market conditions. Empowering the CRO with clear, consistent KPIs allows for more objective performance assessment and a longer runway for impact.

3. Drive Cross-Functional Buy-In for Sustainable Growth

For many PE-backed companies, especially in SaaS, CROs struggle with gaining the necessary buy-in from teams traditionally accustomed to independent operation, like sales. Sales teams, in particular, may resist CRO oversight if they feel their autonomy is under threat. Building team alignment requires a concerted effort to unify these functions under a shared vision for growth.

Recommendation

Make alignment a priority across sales, marketing, and customer success by fostering collaboration at the leadership level. Encourage the CRO to lead with transparency, engaging other team leads in strategic planning and decision-making. When all teams understand the CRO’s role and how it impacts their own metrics, they’re more likely to work cohesively. This alignment also helps the CRO develop strategies that enhance performance across the board.

4. Prioritize Process Over Technology

In mid-market, high-growth companies, the pressure to implement sophisticated tech stacks can lead CROs to focus on tools over processes. Without established processes, however, technology investments are often wasted, and the CRO ends up spending more time hunting for actionable insights than driving growth.

Recommendation

Evaluate existing revenue processes before introducing new technology. This approach can help the CRO identify and eliminate friction points in the sales funnel and customer journey. Once processes are optimized, technology can enhance and streamline revenue operations rather than hinder them. A data-driven but process-first strategy provides a more resilient foundation for sustained growth and better-informed decision-making.

The Path Forward

For executives at Private Equity backed firms, minimizing CRO turnover is more than just preserving stability; it’s about ensuring that the right leadership is in place to accelerate revenue growth. While hiring external CROs is often appealing due to their experience, grooming internal talent can yield more cohesive results, as the HBR article suggests. However, whether hired internally or externally, CROs need a clear mandate, aligned metrics, team buy-in, and a focus on process. Implementing these strategies creates a sustainable revenue engine, accelerating revenue growth and enhancing enterprise value.

Craig Group Partner Ajay Joshi is a seasoned revenue operations consultant with over 20 years of experience enhancing operational and financial performance across sales, marketing, operations, and technology.