Marketing to Meet Investor Expectations

Summer Craig, President and Founder of Craig Group recently spoke with Softeq Venture Studio, an accelerator program that helps founders build investable technologies and businesses. Craig’s presentation included topics on investors’ expectations, business goals, market strategy, and return on investment.

The goal for every investor is to make money. Making a good investment relies on several factors like market strategy, revenue potential, risk, goals, and more. Here are some insights into marketing from an investment perspective to help middle market companies think about their approach to growth.

HOW DO INVESTORS EVALUATE A COMPANY’S POTENTIAL?

Investors think about 4 key areas of business. The first is the EBITDA margin, an earnings measure of a company’s operating profit as a percentage of its revenue. This margin allows for a comparison of one company’s actual performance to others in its industry. Investors care about the EBITDA margin because it shows them the cost of operating expenses in relation to total revenue.

The second is recurring revenue, the portion of a company’s revenue that is expected to continue in the future. These revenues are predictable, stable, and investors can rely on them in the future with high certainty. Recurring revenue is important to investors because revenue determines the profitability of a business.

Third, is the scalability of the business or the organization’s capacity to adapt to an increased workload or market demands. Scalability is important to investors because they need to know if a business has the proper resources to increase production to meet demand.

The fourth area investors think about is if the ultimate buyer for a company will be a strategic or financial buyer. A financial buyer is a long-term investor interested in the return that the purchase will achieve. Whereas a strategic buyer evaluates an acquisition primarily on how it fits with their own strategic goals.

WHAT ARE THE KEY ELEMENTS OF A MARKETING STRATEGY?

The goals for an effective marketing strategy are to grow top line revenue, target the most profitable customers, reach potential customers at scale, and build a positive brand reputation. Building an effective marketing strategy starts with a clear understanding of the business’s end goals, namely revenue growth and identifying who and where the ideal target audience is.

There are 7 key parts of a strategic marketing plan to keep in mind:

-

- Ideal customer profiles/personas

- Marketing Goals

- Customer Journey

- Competitor Analysis

- Differentiators

- Messaging

- Pricing Structure

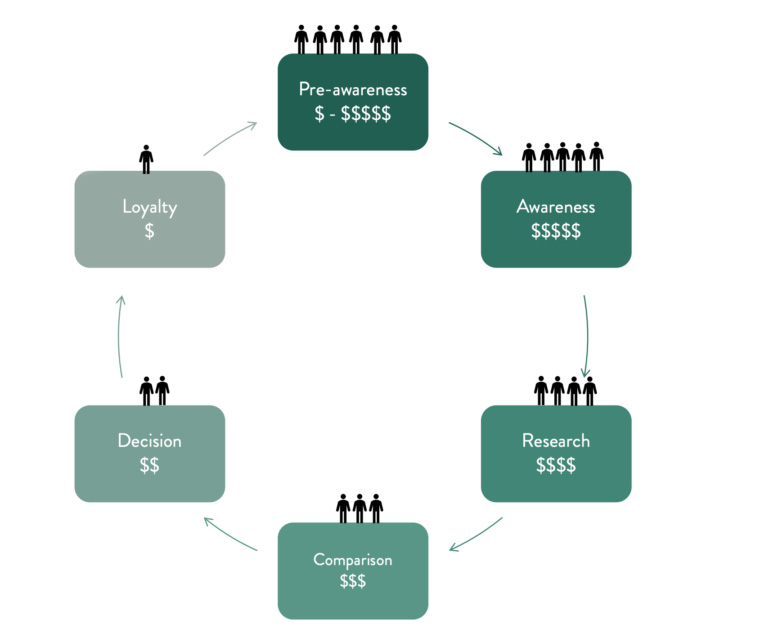

MARKETING CYCLE

HOW DO INVESTORS EVALUATE RETURN ON INVESTMENT (ROI)?

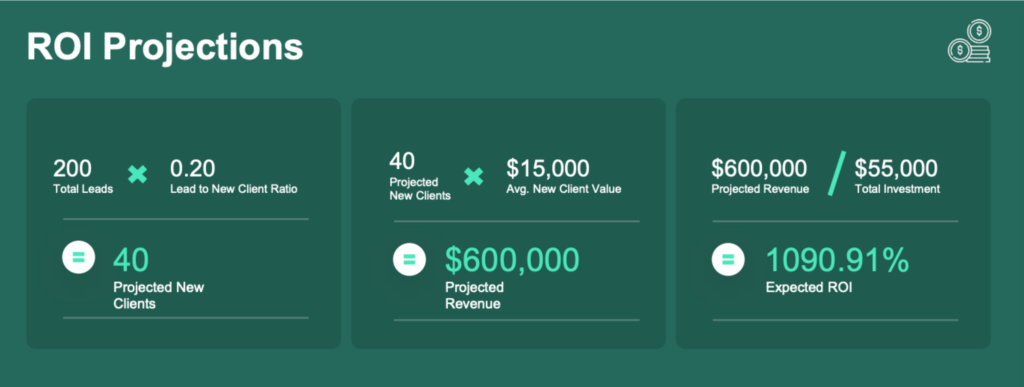

ROI is a key measure to help investors understand how much profit or loss an investment has earned. Investors may use ROI to evaluate their portfolios, or assess almost any type of expenditure. Calculating ROI comprises the total investment, measuring data on projected new clients, and the projected new revenue new clients will bring to the business. If spending $55,000 on media generated $600,000 in projected revenue, the business owner would get a 1,090.91% expected ROI on media expenditure.

Thinking like an investor helps a company’s management team develop a marketing plan that prioritizes revenue, growth and scalability. It also helps the team to track those goals using metrics that investors care about most.

For more information about the marketing strategies that matter to potential investors, visit www.craigmarketinggroup.com.

MEDIA CONTACT:

Tricia Eaton tricia@craigmarketinggroup.com