Avoiding the Headwind: Your PE Growth Q1 Playbook for 2025

With the new year underway, it’s natural to celebrate your Q4 wins and give yourself and your team a moment to reset. After all, closing out the previous year likely meant a frenetic push to meet goals, and a collective exhale can feel well-earned. But for private equity (PE)-backed revenue teams, hitting the brakes in Q1 can lead to a BIG growth mistake. That’s why having a solid PE Growth Q1 Playbook can make all the difference in staying on track.

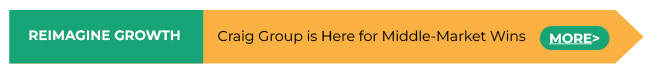

Here’s the reality: PE-backed companies are under the microscope. Your performance is scrutinized more than most businesses, and falling behind early in Q1 can ripple into challenges for the rest of the year. By February, if your team hasn’t made significant progress on your quarterly or annual revenue targets, you’re already playing catch-up.

Why is Q1 revenue performance so critical? Let’s break it down:

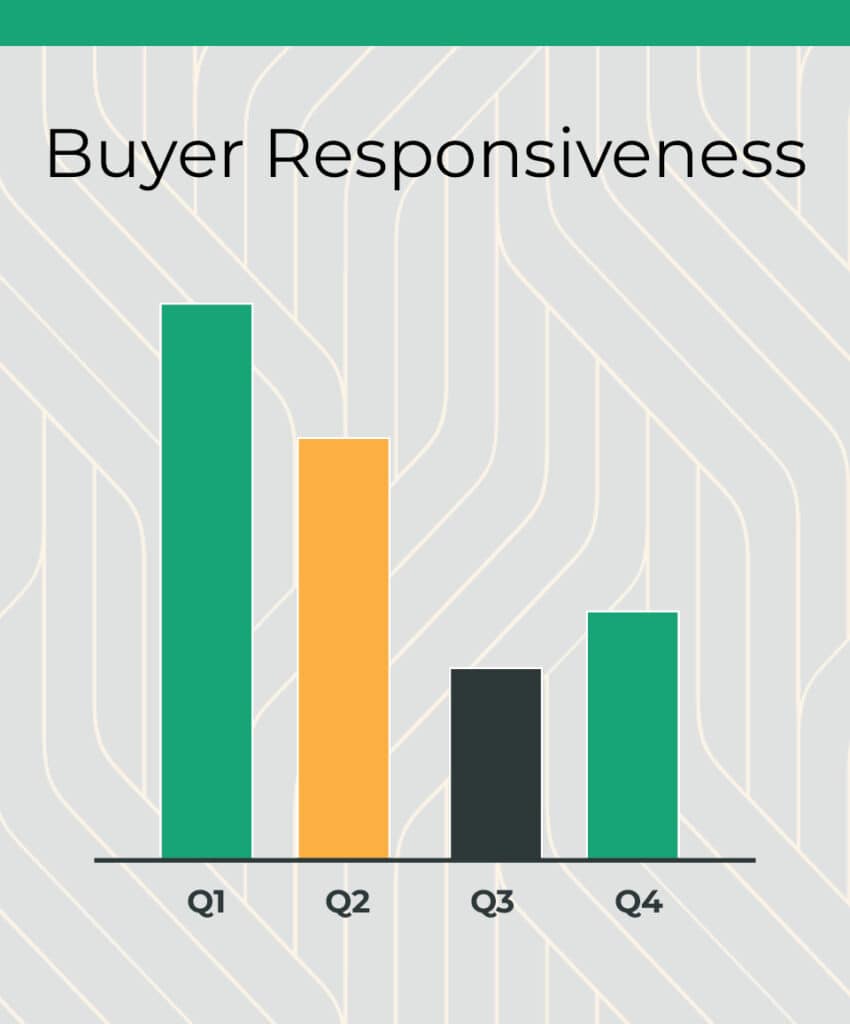

- Q1 Is a Reset for Prospects Too: Just like your team, your prospects are starting fresh. They’re likely reviewing new budgets, setting goals, and open to exploring solutions.

- Psychological Receptiveness: Early in the year, buyers are more open to outreach before the rush of mid-year priorities and distractions.

- New Budgets, New Momentum: Many decision-makers have fresh funds to allocate and are ready to move forward.

- Seasonal Slowdowns Loom: Spring break and summer travel in Q2 and Q3 often delay buying decisions, making Q1 momentum even more vital.

Bottom Line: A slow start in Q1 compounds stress and makes hitting your annual targets significantly harder.

But the good news? There are actionable steps you can take right now to maximize Q1 revenue potential and ensure your team’s success.

Your Q1 Rapid-Start Plan

Here are seven steps to keep your revenue engine humming from day one:

- Reengage Low-Hanging Fruit: Circle back with prospects that didn’t close in Q4. These opportunities are already warm and could convert with minimal effort.

- Validate Your Ideal Customer Profile (ICP): Analyze deals that closed in Q4 to refine your ICP and ensure your efforts are laser-focused on high-potential prospects.

- Update Sales Enablement Tools: Equip your team with fresh case studies, success stories, and other materials to highlight the tangible benefits of your solutions.

- Segment Past Prospects: Use your updated ICP to identify prospects from the previous year who didn’t close and reengage them with targeted campaigns.

- Launch Peer Selling Campaigns: Highlight vertical-specific wins from Q4 to attract new prospects in the same industry who don’t want to miss out.

- Leverage Team Selling: Involve subject matter experts (SMEs) or other team members in sales conversations to build trust and credibility with buyers.

- Offer Q1 Incentives: Provide compelling incentives, like low-cost add-ons or limited-time discounts, to encourage buyers to act now.

A Proven Formula for Early Momentum

The most successful sales teams I’ve seen don’t waste a second in Q1. They focus on momentum, closing leftover deals from Q4, and capitalizing on FOMO (fear of missing out) within specific verticals. For example, if your team closed several car dealership deals in Q4, reach out to similar dealerships in Q1 with peer-based success stories. This strategy creates urgency and positions your offering as a must-have.

While it might be tempting to relax and take a breather at the start of the year, doing so could leave your team trailing behind. Instead, view Q1 as a golden opportunity to engage buyers when they’re most receptive. Waiting too long allows competitors to swoop in and makes prospects more resistant to sales outreach later in the year.

Avoiding the Growth Headwind

Failing to engage your best-fit buyers early in Q1 creates a self-inflicted growth HEADWIND. Don’t let your revenue goals fall behind before the year has even begun. Instead, act decisively to ensure your team capitalizes on the opportunities in front of them.

Ready to Scale Faster in 2025?

Craig Group Partner Brian Gustason writes about PE revenue growth on LinkedIn. Are you looking to scale your PE portfolio businesses faster in 2025? Contact us.